As I check out the Dow Jones Industrial Average (DJI), down more than 13% from its all-time high on January 5th, 2022, inflation at a 40-year high, most analysts believe that we’re already in a bear market.

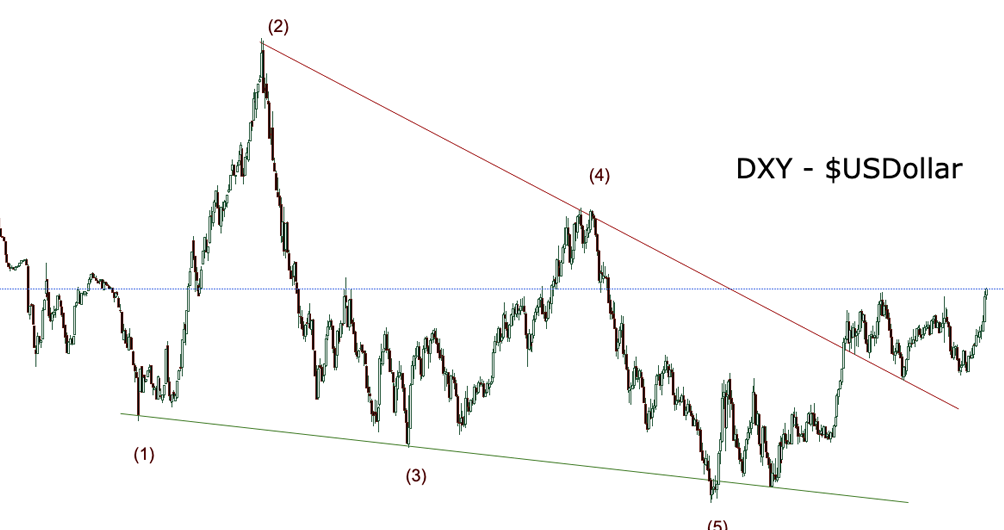

As I check out the Dow Jones Industrial Average (DJI), down more than 13% from its all-time high on January 5th, 2022, inflation at a 40-year high, most analysts believe that we’re already in a bear market. On the contrary, the US Dollar (DXY) is at a five-year high.

Most top analysts think we’re in the midst of or even headed towards a recession and or depression.

- What is a recession? A recession is a period of temporary declining economic performance across an entire economy, generally identified by a fall in GDP (Gross Domestic Product) in two successive quarters.

- What is an economic depression? A prolonged and severe downturn in economic activity. In economics, a depression is an extreme recession that lasts three or more years and leads to a decline in GDP of 10% or more.

The thing some investors think is contradictory is that although inflation is at a 40-year high, “how can the USDollar” appear to be headed towards multi-year highs. In other words, the Dollar should be weakening instead of strengthening.

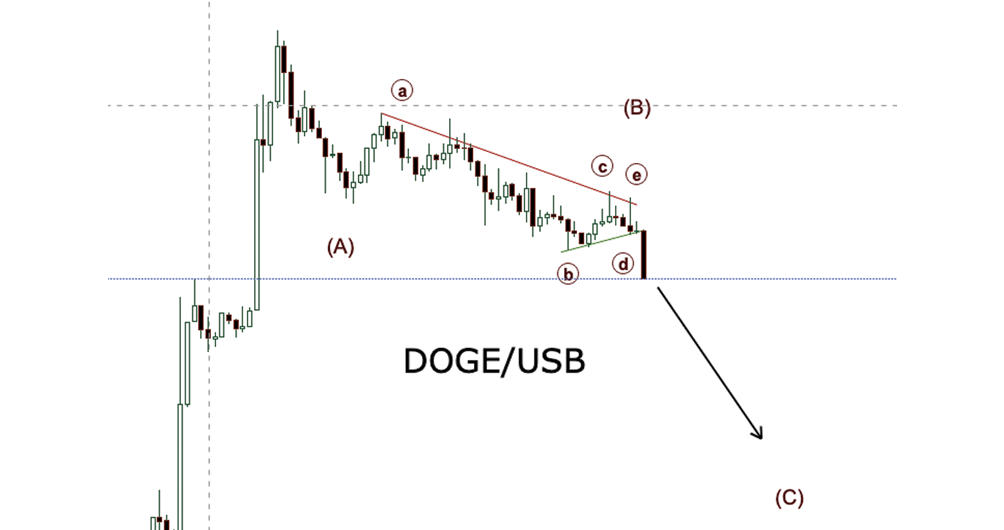

This leads me to the log-awaited topic “Cryptocurrency.” You may notice Crypto being measured against the US Dollar.

What do I mean? Such as: Doge/USD, Shib/USD, XRP/USD, Btc/USD, etc. So, therefore a great deal of times, as the DXY rises, the adjacent will decrease over the long-term measurement. Now, this is not the case in all situations, but this is a great way to measure currency. Another example would be USD/EUR. Traveling complete opposite of each other.

Take a min to study the charts attached to this article. The USD appears to be in an ending diagonal pattern. If this pans out, there’s a great chance that we may see the USD at or around $1.60.

If you like this article please comment and check back for more updates.