It’s been an excellent month for cannabis stocks and it’s not hard to see why. All evidence points to the fact that the federal government is considering rescheduling the recreational drug from Schedule I to Schedule III.

These “schedules” refer to the government’s classification of a drug’s severity with Schedule I being the highest. This puts it in the same category as heroin and LSD, a classification that many feel is inappropriate. I tend to agree. According to Scientific American, “experts say listing cannabis among the world’s deadliest drugs ignores decades of scientific and medical data.” Now, the arguments for loosening restrictions on cannabis may finally be working.

President Joe Biden has asked the U.S. Department of Health and Human Services (HHS) to review how marijuana is classified, implying that he believes it should be rescheduled. HHS has recommended a rescheduling, and now the decision rests with the DEA.

Historically, cannabis policy has been seen as a left-wing cause with Republicans strongly opposing it. But in what Bloomberg calls a “rare moment of progress,” rescheduling is garnering support from both sides of the aisle. Both Senate Majority Leader Chuck Schumer (D-NY) and Rep. Matt Gaetz (R-FL) are in agreement that action should be taken to ease the current laws. This momentum is boosting cannabis stocks while the country waits for updates on the rescheduling.

Which Cannabis Stocks Will Benefit the Most?

With a major policy change on the horizon, investors should be looking for the best ways to stay ahead.

This requires an in-depth analysis. It’s true that this positive momentum has boosted the entire sector, sending both large- and small-cap companies into the green. However, that doesn’t mean that all cannabis stocks will see the same growth.

Many of the sector’s most popular names include less stable firms such as Tilray Brands (NASDAQ:TLRY) and Cronos Group (NASDAQ:CRON). Both names have mostly stayed relevant due to meme stock status.

Wanting to learn more about which cannabis stocks stood to gain the most, I reached out to Avis Bulbulyan. A noted industry veteran, Bulbulyan is the CEO of SIVA Enterprises, a California-based cannabis consulting firm. He offered the following take:

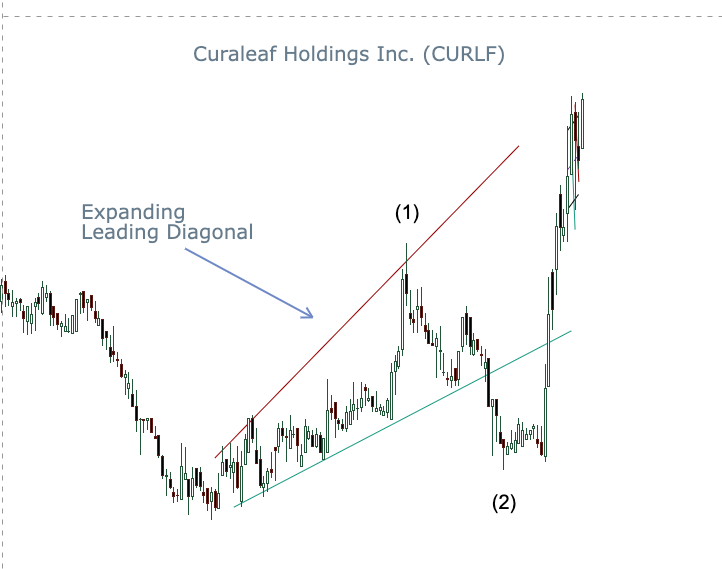

“The initial response is going to be generally favorable across the board for the majority of cannabis stocks. The ones that will benefit most are going to be the ones that have a healthy balance sheet and are more focused as a company. I believe the better positioned ones and those that will benefit most will include Green Thumb Industries (OTCMKTS:GTBIF), Trulieve Cannabis (OTCMKTS:TCNNF), [and] Curaleaf Holdings (OTCMKTS:CURLF).”

Bulbulyan’s bullish argument on all these companies makes sense. All three have dramatically outperformed cannabis stocks like Tilray over the past month. These three firms are also based in the U.S. That’s likely to give them a competitive edge over their Canadian peers if the federal government moves forward with rescheduling cannabis.

Additionally, Bulbulyan notes that if marijuana is reclassified as Schedule III, it will move medical cannabis into the hands of pharmaceutical companies which have the necessary licenses to deal with schedule 3 drugs.

As both Green Thumb and Curaleaf operate in this space, this type of progress would likely boost them even further. The latter is close to climbing out of penny stock territory. If rescheduling moves forward, it could easily pass the $5 mark permanently and stay there, taking its rightful place among the top cannabis stocks.

The Bottom Line

Because of the popularity of their product, it can be easy for companies in the cannabis space to capture the attention of the meme stock crowd.

Investors seeking long-term profits, though, should be careful to examine the sector from a macro perspective.

Yes, a federal reclassification that recognizes cannabis as a less lethal drug will create momentum that pushes cannabis stocks up. But some companies have the type of growth potential that is necessary to keep riding the wave after the market moves on.

The three cannabis stocks I have noted above have outperformed their meme stock peers for a reason. They will likely continue to do so, regardless of how the DEA proceeds.

On the date of publication, Samuel O’Brient did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.comPublishing Guidelines.

Samuel O’Brient has been covering financial markets and analyzing economic policy for three-plus years. His areas of expertise involve electric vehicle (EV) stocks, green energy and NFTs. O’Brient loves helping everyone understand the complexities of economics. He is ranked in the top 15% of stock pickers on TipRanks.