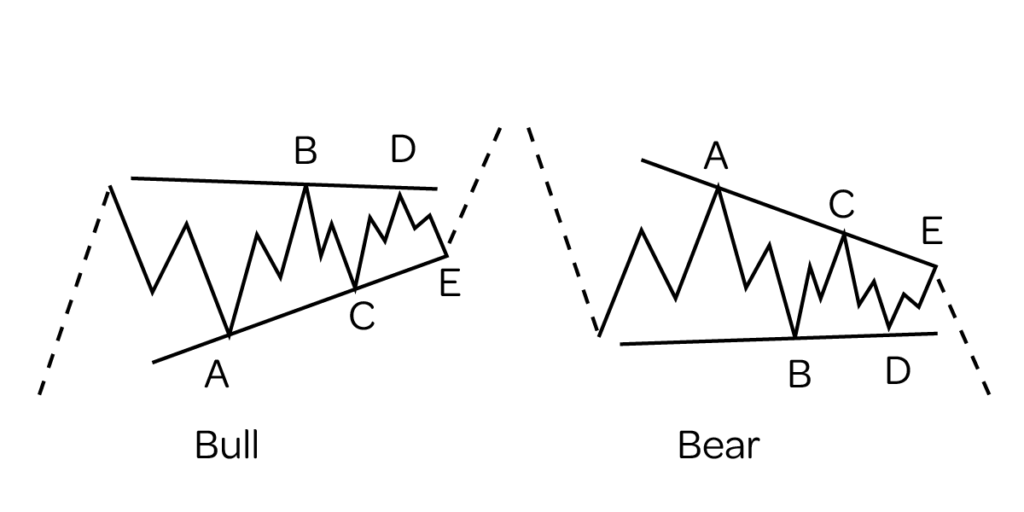

Reading Time: 2 minutesUnderstanding Elliott Wave Triangles: A Guide for Traders What Are Elliott Wave Triangles? Elliott Wave triangles are corrective wave patterns that typically appear in wave four of an impulsive wave sequence or as part of wave B in an A-B-C corrective structure. These formations indicate a temporary pause in the market before the trend resumes[More…]

Dissecting The All Too Famous Zig-Zag Pattern

A zigzag in a bull market is a simple three-wave declining pattern labeled A-B-C. The wave sequence is 5-3-5.

- A three wave move in Wave A, signals a flat or triangle for Wave B

- A triangle always occurs in a position prior to the final wave

- Wave C is the final wave in the sequence