Costco is well-known as a place to get bargain prices on any variety of items, from food to luggage to appliances to gold bars.

Wait, gold bars?

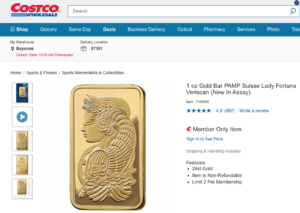

Yes, the retail warehousing giant is your one-stop shop for 1 ounce gold PAMP Suisse Lady Fortuna Veriscan bars, handsomely detailed and ready for purchase.

They’re available for the bargain price of … well, you have to be a member to know that, but apparently they were selling for a little shy of $1,900 recently, according to chatter on Reddit. Spot gold most recently was going for $1,876.56 an ounce as of Wednesday afternoon.

Regardless of the price, gold is selling like hotcakes, judging by comments Tuesday from Costco Chief Financial Officer Richard Galanti. Speaking on the company’s quarterly earnings call, Galanti said the bars are in hot demand and don’t last long when in stock.

“I’ve gotten a couple of calls that people have seen online that we’ve been selling 1 ounce gold bars,” he said. “Yes, but when we load them on the site, they’re typically gone within a few hours, and we limit two per member.”

A couple of important points from that thought: The bars indeed are only available online, and only if you’re a Costco member, which costs either $120 or $60 a year, depending on which program you pick. The retailer also is limiting the purchases to two to a customer, meaning it would be pretty hard to build a position that would lead to financial security.

At the very least, though, it’s an effective promotion and one that could appeal to a certain sector of Costco’s shopping clientele, said Jonathan Rose, co-founder of Genesis Gold Group.

Rose noted that the company seems to have accelerated its offerings of dried foods and other survivalist goods at a time when worries about the future are running high. For example, the company markets a 150-serving emergency food preparedness kit that could come in handy, you know, just in case. Gold meshes with that type of product.

“They’ve done their market research. I think it’s a very clever way to get their name in the news and have some great publicity,” he said. “There is definitely a crossover of people living off the land, being self-sufficient, believing in your own currency. That’s the appeal to gold as a safe haven as people lose faith in the U.S. dollar.”

Precious metals have been on a run over the past several years. Gold has risen more than 15% over the past year and more than 55% over the past five years.

With inflation still elevated, banks under the gun from a regulatory standpoint and looming issues in the commercial real estate market, the safe-haven aspect of gold and silver should be strong, Rose said.

“We know what the road map looks like: Bank failures, commercial loans defaulting at an alarming rate … they don’t seem to have a handle on inflation, and that’s why they keep raising interest rates,” he said. “The outlook for stability in the market isn’t good and people want a [tangible] asset that’s going to be a safe haven. That’s what gold and silver provide.”

The hoarding of gold bars is a hot topic lately after U.S. Sen. Bob Menendez of New Jersey was indicted on federal bribery charges and 81.5 ounces in bullion were seized from his home.