DJIA, Stock Market, Stocks

Don’t Miss the Boom: 3 Short-Squeeze Stocks Set to Explode Higher

- These are the short-squeeze stocks to consider buying for a big rally in the coming months.

- EVgo (EVGO): Stellar revenue growth will likely sustain in the back of the new EV stall construction pipeline.

- Marathon Digital (MARA): Strong growth in mining capacity will translate into robust growth when Bitcoin trends higher.

- Lucid Group (LCID): This stock is deeply oversold, and the Company is fully financed for investments in the next 12 months.

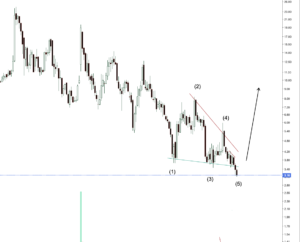

Investor emotions and sentiments drive markets, and sometimes reactions can be extreme. There can be phases of euphoria where valuations defy logic. Similarly, in a bear market, the downside translates into a deep valuation gap. The best way to make quick money is to use these extremes to initiate short and long positions. A strategy that has delivered success in the last few years is the focus on short-squeeze stocks.

To elaborate, there are stocks that overreact on the downside. These can be fundamentally strong or speculative stocks. However, even after a deep correction, there are cases where short interest in the stock is high as a percentage of free float. Even a small rally in these stocks can trigger short covering, translating into big upside at the blink of an eye.

This article focuses on three deeply oversold stocks with high short interest likely to explode higher in the coming months.

Let’s discuss the reasons to be positive on these short-squeeze stocks to buy for a massive rally.

EVgo (EVGO)

Source: Tada Images / Shutterstock.com

EVgo (NASDAQ:EVGO) looks attractive for a big short-squeeze rally after a decline of 62% in the last 12 months. After the massive correction, EVGO looks undervalued, but the short interest remains high at 25%. I would not be surprised with a rally of 50% to 100% in quick time.

It’s worth noting that for Q2 2023, EVgo reported stellar revenue growth of 457% on a year-on-year (YoY) basis to $50.6 million. The company has 3,200 stalls in operation or under construction. That provides clear growth visibility. In another positive business development, the company has received the first shipment of 350Kw high-power fast chargers from Delta Electronics.

However, EVGO stock has plunged due to two reasons. First, the EV charging infrastructure sector is getting intensely competitive. Further, EVgo expects an adjusted EBITDA loss of between $68 million and $78 million for the year. Cash burn is a key concern. Having said that, EVGO stock is attractive even after discounting these factors.

Marathon Digital (MARA)

Source: Yev_1234 / Shutterstock

Marathon Digital (NASDAQ:MARA) stock touched highs near $19.9 in July. A renewed correction in Bitcoin (BTC-USD) triggered an overreaction on the downside and MARA stock now trades at $8. I believe a 100% rally from current levels is on the cards within the next 12 months. It’s worth noting that even after a deep correction, the short interest in the stock is at 23% of the free float.

From a business perspective, there are a few positives to note. As of Q2 2023, the company reported an operational hash rate of 12.1EH/s. However, the installed hash rate had increased to 21.1EH/s. In August, Marathon achieved the first target of boosting capacity to 23EH/s.

Once Bitcoin trends higher, the growth in mining capacity will translate into robust revenue and cash flow upside. Also, the company’s joint venture in Abu Dhabi is already pursuing the next leg of mining capacity expansion. Therefore, with a healthy growth outlook, the correction is overdone, and MARA stock is likely to surge higher.

Lucid Group (LCID)

Source: Khosro / Shutterstock.com

Lucid Group (NASDAQ:LCID) stock is another name among short-squeeze stocks that looks interesting at current levels. The short interest in the stock remains high at almost 25%, even after a plunge of 64% in the last 12 months.

Of course, the correction in LCID stock is justified. First, the company has been behind in terms of production and sales. Further, the cash burn has been significant, and equity dilution has translated into stock correction. Having said that, the downside is overdone in the near term, and I expect a strong rally of 50% from current levels.

At least for now, Lucid has a strong liquidity buffer of $6.25 billion. That ensures the company is financed through 2024. I am, however, expecting further dilution of equity in late 2024 or in 2025. The business will also commence production of Lucid Gravity towards the end of next year. It’s a likely catalyst for delivery growth acceleration in 2025.

On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Faisal Humayun is a senior research analyst with 12 years of industry experience in the field of credit research, equity research and financial modeling. Faisal has authored over 1,500 stock specific articles with focus on the technology, energy and commodities sector.